Investing in Consumer Goods and Retail: is it time to go shopping?

29.9.2024It’s been a challenging few years for Consumer Goods and Retail companies. The pandemic, supply chain disruptions, rising interest rates and cost of living pressures have all had an impact on profits in the sector.

Of course, some companies did quite well during the pandemic. Think online shopping, home delivery meal boxes and camping equipment, which have all thrived from lockdowns and the shift to work from home. But from an M&A perspective, it’s been tricky for investors to assess “maintainable earnings” as either:

- Companies performed well, but it was hard to say how much of the improvement was a “sugar hit” and how much was a sustainable shift in spending patterns; or

- Earnings have been hit, and it’s been hard to assess how much of the dip was due to COVID-19/supply chain issues

So, the question is, has enough time now passed for us to understand what “the new normal” is? We’ve spent the last few months meeting with companies and investors in the sector, and here’s what we’ve learned:

- The worst of COVID-19 may have passed (touch wood), but there are still plenty of challenges to deal with. In particular, cost of living pressures and labour costs/availability continue to impact companies in the sector;

- The use of technology has increased in importance, although the adoption of e-commerce channels appears to have reverted to long-term trends following a bump during COVID-19;

- Investor interest is increasing, but there’s a clear preference for less discretionary products – for example, food, pet and health-related products;

- Companies need to have a clear picture of their target consumer, with a preference for those less impacted by interest rates – either older age brackets without a mortgage, or younger age brackets not afraid to splash out for some avo on toast!!

- Along the same lines, premium brands and “affordable” treats are performing well, while brands at mid-rage price points are seen as “stuck in no-man’s land”. The risk here is that consumers switch their spending from mid-range to cheaper alternatives as cost-of-living pressures bite;

- Offshore buyers are actively targeting Australia, particularly from the US and Asia;

- There is a lack of privately owned, high-quality assets of scale, so companies with this profile are likely to attract significant interest and premium valuations.

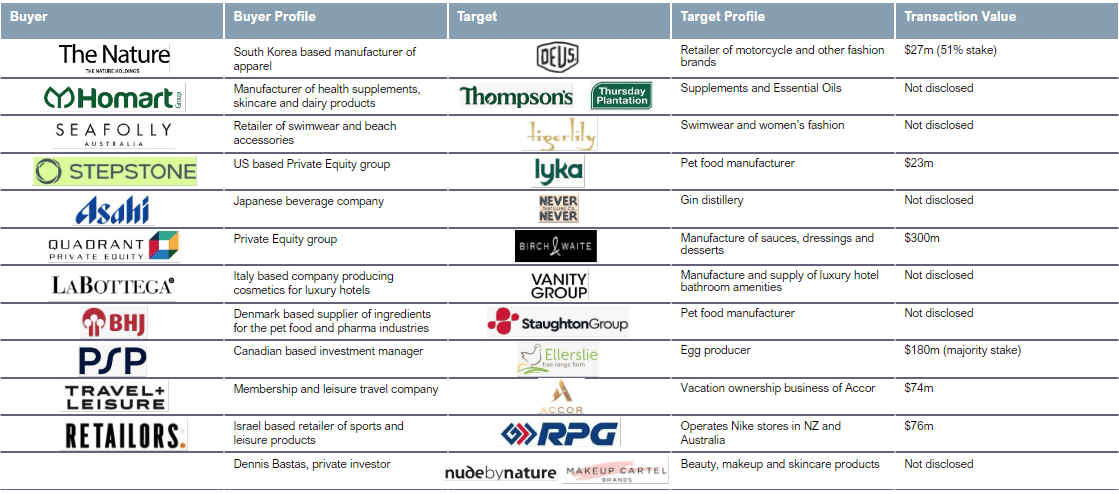

- As evidenced by the following, transactions in the sector are getting done:

This increasing interest from investors can be seen in the valuation metrics. Since June 2022, the average forward EV/EBITDA multiple for ASX-listed companies in the sector has increased from 6.5x to 8.4x. Appropriate discounts need to be applied for smaller, private companies, but this demonstrates increasing confidence that some normality has returned and that future growth prospects are reasonable.

So yes, there are still some challenges facing the Consumer Goods and Retail sector. But with investor interest returning and market conditions somewhat stabilising, we also see some great opportunities for business owners in the sector to grow and realise value in the next few years.

Need expert guidance in navigating this dynamic sector? Contact Mark Steinhardt, Executive Director at InterFinancial. With over 20 years of experience, Mark leads our Consumer Goods and Retail practice and has led several industry transactions in recent years. InterFinancial is globally supported by a highly experienced team through our partnership with Clairfield International.