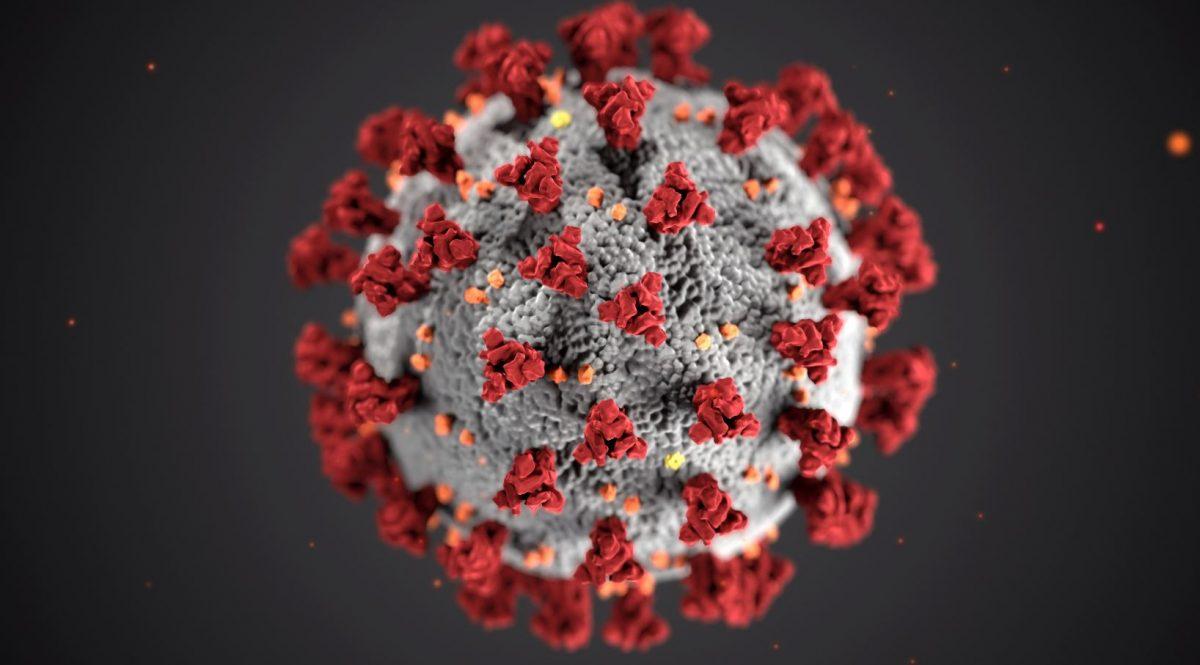

InterFinancial have taken active steps to ensure the safety, health and well-being of our people, clients and wider community. We are implementing new workforce policies at InterFinancial to help “flatten the curve” of COVID-19 and accordingly we have moved to work from home arrangements for all our staff.

To the best of our knowledge, no one in our team has been exposed or is showing symptoms of the virus, we are just working as part of the community to slow the spread.

Please feel free to communicate with us on the usual basis under our working from home arrangements. We have the capability and systems in place to operate remotely and provide our clients with a ‘business as usual’ service. Our staff are currently permitted to attend any essential meetings in person otherwise all meetings will be conducted via video conference technology, such as Teams or Zoom, phone calls or rescheduled.

These arrangements will be in place until Easter and then re-evaluated in light of rapidly changing circumstances, or until any other restrictions that the government enforces.

We appreciate that this may be disruptive and we would like to thank you for your understanding and support. All of these measures are taken with the aim of protecting everyone’s well-being while continuing to deliver the highest level of service to our clients.

Sector dashboards January 2026

Our monthly sector dashboards are out! Our dashboards look at the valuation multiples across seven key sectors, each made up of a number of subsectors. The data takes into account the sale prices of similar companies based on; products, end markets, services, assets classes or other characteristics. The publications include all companies listed on the […]

Read more

What has 2025 taught us about APAC M&A and what comes next in 2026?

As we kick off the new year, we went around the InterFinancial team and asked a simple question: What did you see in the APAC M&A market in 2025, and what does it mean for 2026? The answers were candid, thoughtful and in some cases, refreshingly blunt. While the headlines were dominated by AI hype, geopolitical noise and regulatory change, the […]

Read more

Sector dashboards December 2025

Our monthly sector dashboards are out! Our dashboards look at the valuation multiples across seven key sectors, each made up of a number of subsectors. The data takes into account the sale prices of similar companies based on; products, end markets, services, assets classes or other characteristics. The publications include all companies listed on the […]

Read more

Sector dashboards November 2025

Our monthly sector dashboards are out! Our dashboards look at the valuation multiples across seven key sectors, each made up of a number of subsectors. The data takes into account the sale prices of similar companies based on; products, end markets, services, assets classes or other characteristics. The publications include all companies listed on the […]

Read more

APAC Tech M&A: What Q3 trends mean for Aussie sellers?

MergerMarket and DataSite have released their Asia Pacific Q3 M&A report and it’s full of insights for technology founders thinking about an exit in the next few years. While activity has slowed from previous highs, tech is still the most active sector across the region, and the pipeline of companies preparing for sale remains deep. […]

Read more

Sector dashboards October 2025

Our monthly sector dashboards are out! Our dashboards look at the valuation multiples across seven key sectors, each made up of a number of subsectors. The data takes into account the sale prices of similar companies based on; products, end markets, services, assets classes or other characteristics. The publications include all companies listed on the […]

Read more

Caterpillar’s $1.1bn Acquisition of RPMGlobal: Why the deal signals a broader shift in mining technology M&A?

Caterpillar’s bold moves Caterpillar Inc (NYSE: CAT), the world’s largest mining equipment manufacturer, has announced a definitive agreement to acquire ASX-listed mining software leader RPMGlobal Holdings Limited (ASX: RUL) for A$5.00 per share. This values the company at $1.1 billion and represents a 32.6% premium to the last undisturbed price. The all-cash transaction will be […]

Read more

FY25 Consumer Goods and Retail Sector Update: Where to get the most bang for your buck?

It’s been an interesting year for the Australian Consumer landscape. With the high inflation / high interest rate setting of previous years’ easing, we’ve been eager to see whether this would translate to increased M&A activity. Analysing the data, it’s clear that investors are shopping, but being extremely picky about what they add to their cart. Crunching the numbers According to the ABS, monthly retail turnover […]

Read more

Sector dashboards September 2025

Our monthly sector dashboards are out! Our dashboards look at the valuation multiples across seven key sectors, each made up of a number of subsectors. The data takes into account the sale prices of similar companies based on; products, end markets, services, assets classes or other characteristics. The publications include all companies listed on the […]

Read more