Strategic Planning Tips For Successful Acquisitions

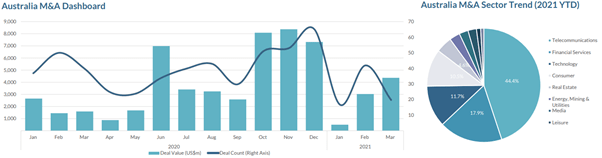

31.3.2021Australian M&A activity is on the rise, with $8 billion in transactions closed so far this calendar year, up 30% year-on-year.1 Both financial and strategic investors are taking advantage of cheap debt and strong economic tailwinds to identify value adding acquisitions.

Of course, identifying acquisitions and making them work are two very different things. A recent global M&A study concluded that 79% of companies who had recently completed an acquisition believed they successfully executed the acquisition, but only 35% believed they achieved operational success and sustained value creation.

How then should companies plan for a successful acquisition that delivers long-term value?

- Setting defined outcomes and criteria

One of our mantras is that acquisitions should only be pursued if they accelerate a strategic objective of the company. Companies should have a defined growth plan, and understand how acquisitions can help to deliver this plan. This includes setting clear criteria for targets, understanding the objectives of both the buyer and seller, defining what “success” means for the acquisition, and regularly testing these assumptions as you proceed through the acquisition process.

- Keep your core business a priority

Running an acquisition process is time consuming and distracting. A clear plan is required to understand who is responsible for each activity, and making sure that the process doesn’t negatively impact the core business.

- Due Diligence

Effective planning allows for the acquiring business to thoroughly complete due diligence on the target, identifying and assessing areas of potential risk. All dimensions of the transaction should be addressed including validation of key commercial assumptions as well as financial, legal, tax, and other transaction specific items.

- Maintain confidentiality and clear motivations

Key stakeholders for both the buyer and seller will likely be unaware of the M&A process until a binding agreement is executed and announced. Maintaining confidentiality throughout the process is crucial to protecting employee, customer and other key relationships. Once the transaction is complete, there needs to be a clear communication plan that addresses likely concerns of each party.

- Early planning of post-merger integration

Many failed acquisitions are the result of poor post-merger integration planning. As the old saying goes, “fail to plan, plan to fail”. As part of Due Diligence, companies should document the objectives, potential synergies, and critical factors that will make the new partnership a success. This early planning allows you to successful track how the implementation process has developed in the periods after the acquisition completes and effectively review where value may be getting lost.

At InterFinancial, we have seen a marked increase in the number of clients running a formal “buyside” search, which includes clarifying their strategic objectives, identifying where acquisitions can accelerate objectives, scanning the market for targets, and engaging with suitable targets through to completion. By running a structured process and following the tips listed above, we can maximise the likelihood of long term value creation, not just short term transaction execution.

1. Tee, Gerry, Mergermarket, “Australia M&A Dashboard” (15 March 2021)