Trends affecting Clean Energy companies

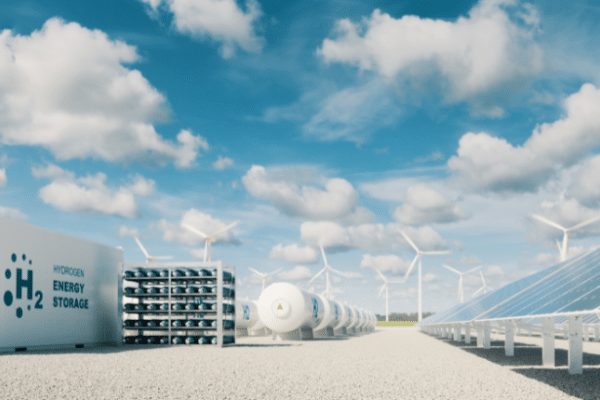

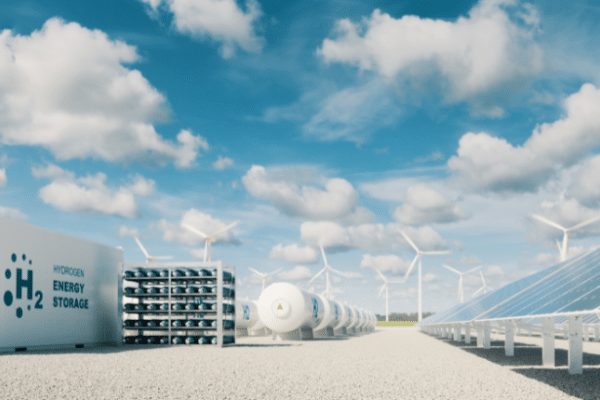

Derek Thomson, Director of our dedicated Clean Energy and ESG division, gives us a wrap up of some of the recent trends affecting Clean Energy companies based on his conversations with clients.

Read more

Derek Thomson, Director of our dedicated Clean Energy and ESG division, gives us a wrap up of some of the recent trends affecting Clean Energy companies based on his conversations with clients.

Read more

Running an M&A process is similar to ultrarunning according to Mark Steinhardt, InterFinancial Executive Director. He’s done a fair bit of both so, after slogging it out over 80kms in Noosa recently, he decided to pen his thoughts on the similarities between M&A and ultrarunning. Originally shared as an article on Mark’s LinkedIn here: ________________ […]

Read more

Our monthly dashboards cover seven key sectors of focus, with each sector built up by several subsectors that cover similar companies based on; products, end markets, services, assets classes or other characteristics. The publications include all companies listed on the Australian Stock Exchange that are actively traded and covered by research analysts, and hence have […]

Read more

Written by Derek Thomson – Director Clean Energy and ESG Motivated by their desire to reduce greenhouse gases, Germany has made bold decisions to turn off nuclear and coal power generation and transition to clean energy. German leaders have made these decisions in the full knowledge it will be temporarily dependent on imported gas. What […]

Read more

Our monthly dashboards cover seven key sectors of focus, with each sector built up by several subsectors that cover similar companies based on; products, end markets, services, assets classes or other characteristics. The publications include all companies listed on the Australian Stock Exchange that are actively traded and covered by research analysts, and hence have […]

Read more

Written by Brad Shaw. When it comes to the state of the market, many have been referring to 2024 as a ‘Goldilocks’ year which feels like a good way to put it. Things aren’t too hot or too cold, they’re just right. But, what does that actually mean? Is 2024 a good year to sell […]

Read more

Being approached by an interested buyer is an exciting prospect for most businesses. When an offer does come through, it’s important that owners take control of the process to ensure it’s competitive and the deal structure makes sense for their business – a process that can be complex and time consuming. If, like Canberra-based ICT […]

Read more

Our monthly dashboards cover seven key sectors of focus, with each sector built up by several subsectors that cover similar companies based on; products, end markets, services, assets classes or other characteristics. The publications include all companies listed on the Australian Stock Exchange that are actively traded and covered by research analysts, and hence have […]

Read more

Anyone in the industry knows there’s no formal qualification in M&A. Everything you learn, you learn on the job. There are highs, there are lows, and it can be lonely at times. That’s why we’re intent on bringing together the M&A community to learn in the best way possible – from each other. Our most […]

Read more