FY25 Consumer Goods and Retail Sector Update: Where to get the most bang for your buck?

28.10.2025It’s been an interesting year for the Australian Consumer landscape. With the high inflation / high interest rate setting of previous years’ easing, we’ve been eager to see whether this would translate to increased M&A activity. Analysing the data, it’s clear that investors are shopping, but being extremely picky about what they add to their cart.

Crunching the numbers

According to the ABS, monthly retail turnover rose 1.2% month-on-month in June, and year-on-year growth was 4.9%. However, volumes (adjusting for inflation) rose only 0.3% in the June quarter. Interestingly, much of the growth is being driven by more discretionary sectors such as recreational goods, cafes and restaurants, suggesting consumers are looking for value/experiences over traditional staple products.

The figures also show that consumers are increasingly shifting to online spending, with online non-food-related sales increasing by 11% over the period. Given ongoing cost of living pressures, it makes sense that consumers are looking online to find better value.

M&A Activity

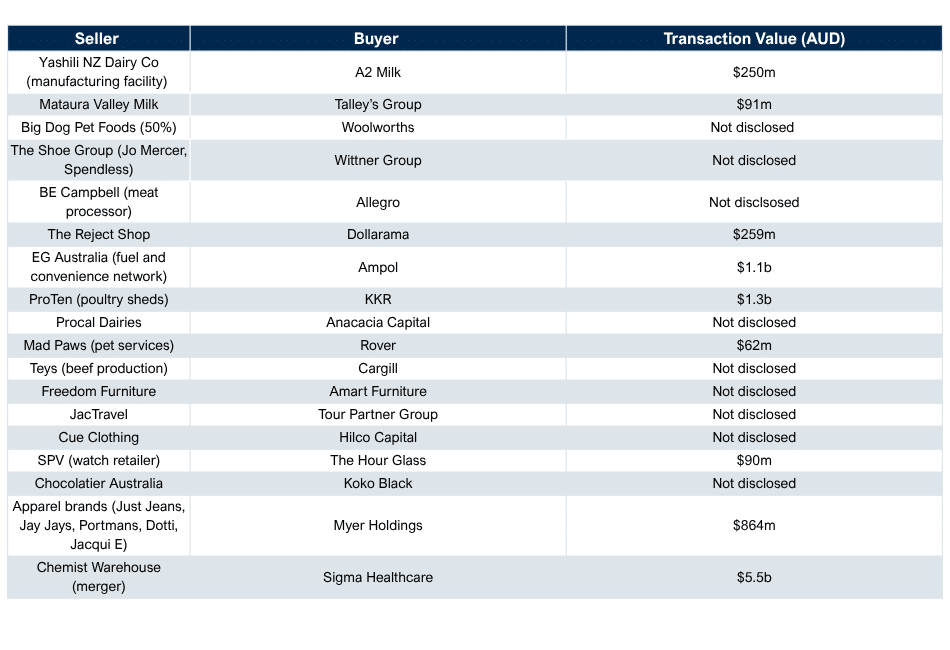

According to Mergermarket figures, ANZ deal volume in the Consumer Goods and Retail sector fell by 8% in FY25, while total deal value fell by 25%. This means that the average transaction size has been smaller, with fewer “mega-deals”. The following table summarises some of the more prominent transactions over the last six months.

Are buyers shopping?

Despite the drop in transaction volumes, it’s clear from our conversations with investors that they’re on the hunt for opportunities. This includes interest from financial and trade investors, both domestic and offshore. So, what are they looking for?

- Less discretionary products. The most important factor is having a clearly defined customer who is less sensitive to macro shocks. Sectors such as food, petcare, medical and wellness products, and motor vehicle accessories are all in demand, as long as sellers can demonstrate resilience over interest rate cycles, a differentiated product offering, and deep engagement with customers resulting in repeat spending patterns.

- Omni-channel capability. It’s becoming increasingly important to have a strong online presence, but for most businesses, it’s not time to ditch the bricks and mortar just yet. Many consumers still prefer in-store shopping, and this often drives impulse buying. However, certain purchases lend themselves to online shopping (e.g. repeat purchases or bulk buys), and in many cases, consumers will compare prices online before buying in-store. So, a seamless integration of online and physical presence is crucial.

- Sustainability and wellness. The shift towards sustainability and wellness continues and is front of mind for investors. Many financial investors will no longer invest in supply chains that aren’t sustainable (think fast fashion), and wellness products with a sustainable competitive advantage are hot property. Of course, the risk of “greenwashing” is real, so brands attempting to own this space need to back up their claims.

- Affordable treats. As the above figures suggest, there’s been a slight shift from staple products to more discretionary “affordable treats”. We all work hard and crave the dopamine hit of a reward, whether that’s a nice meal, a holiday, or a new gadget. So, some level of discretionary spending is ok, but it’s still crucial to demonstrate why your product is not a short-term fad, and how you differentiate from competitors.

- Get the fundamentals right. Regardless of macro trends, and regardless of the sector, it’s always important to get the fundamentals right. Building a business that can survive independently from the founders, demonstrating market differentiation through high profit margins, and mapping out a clear path for future growth all rank highly on investors’ shopping lists.

Conclusion

There are clearly ongoing challenges for the Consumer Goods and Retail sector, with low growth as a category and lower transaction volumes in FY25. But this shouldn’t deter buyers or sellers from looking at M&A in the sector. We’re currently running transactions across food, household goods and motor vehicle accessories, and there’s high demand for good businesses.

If you want to learn more about this sector, contact Executive Director Mark Steinhardt who’d be happy to chat further about the market developments within this sector.