Ready to grow or exit? Meet Shaun Conroy

30.10.2023With this month’s focus on business value, it’s time to meet our newest team member Shaun Conroy. Passionate about helping business owners actualise profitability and valuation growth, Shaun is Director of our growth advisory practice. We spoke to Shaun about his role and the time he spent five hours on a plane with Donald Trump.

Tell us about why you’ve joined InterFinancial

After a career in Financial Services, Investment banking, corporate governance and international trade, I’m experienced in identifying the value drivers in a business and driving improvement. Cash flow, profitability and revenue improvement, succession planning, exit strategies, M&A and corporate governance are all ways to do that.

While many might see InterFinancial as purely an M&A firm, what we really are is specialists in understanding and driving business value. This speciality aligned with my experience. And, after working in large organisations, the InterFinancial team was a breath of fresh air. Incredibly experienced, but small and nimble.

What is your focus in your new role?

In simple terms, I help shareholders find and realise value.

There are several parts to this. What is value and how do you calculate it and how does it differ from revenue and profit?

Value is what an investor is prepared to pay for your business. While there are several valuation models, value is essentially a combination of the recurring profitability of the business times a multiple an investor is prepared to pay for those earnings.

It follows that improving the profitability of the business increases the value, but increase the multiple investors are prepared to pay has an exponential effect on value.

I’m here to assist on that journey. I work with companies 1-3 years before they look to sell, buy or capital raise. I’ll help to identify the business’s value drivers and lead improvement in both the operating profit and valuation multiple.

What areas often get overlooked in terms of driving value?

Investors like predictable earnings, so businesses that are well governed, have predictable cash flows and meet their revenue and profit forecasts are sought after. The basics of a good business are how well people, processes, systems and capital work towards delivering predictable earnings.

What trends are offering the greatest opportunities to increase value?

There are several things that keep business owners awake at night. But, one of the biggest is the attraction and retention of staff. If you couple this with the relatively low productivity of humans, then businesses that quickly learn to harness the power of AI in their workflows will develop competitive advantages.

It has been said that the only sustainable competitive advantage is an organisation’s ability to learn faster than its competition.

What’s the most exciting part of your role?

The business owners we work with are very successful before they come to us. We add value by bringing skill sets and experience to their business in ways they have not considered. If we can use this experience to move the dial on the valuation, we can deliver life-changing impacts for our clients. There is nothing more exciting than to generate these outcomes.

Ok, now the question on everyone’s mind…when and why did you spend 5 hours on a plane with Donald Trump?!

Many years ago, I flew from Tokyo to Hong Kong to go to the Hong Kong Sevens rugby tournament. I had never flown first class before, so I saved up all my mileage and booked a seat at the front of the plane. It is the sort of thing you do when you are young and seemed like a good idea at the time.

The plane was delayed a few minutes pending the boarding of the last passenger and it was Donald Trump who sat down right beside me. I had just read his book ‘The Art of the Deal‘ and we struck up a conversation. For the next 5 hours I had an intense and exclusive chat with the future President of the United States – not that I knew that at the time! It covered off:

•”Have I ever bought an airline? Here, read this report, this one is for sale.”

•The time he went to New Zealand to support a bid for the Auckland Casino licence.

•His superyacht, which he had sold a couple of years before and I saw in Hong Kong. He said he only ever went on it a couple of times.

•Buying the property in Tokyo, the burnt-out shell of the Hotel New Japan.

•New York being the best place in the world to be in real estate.

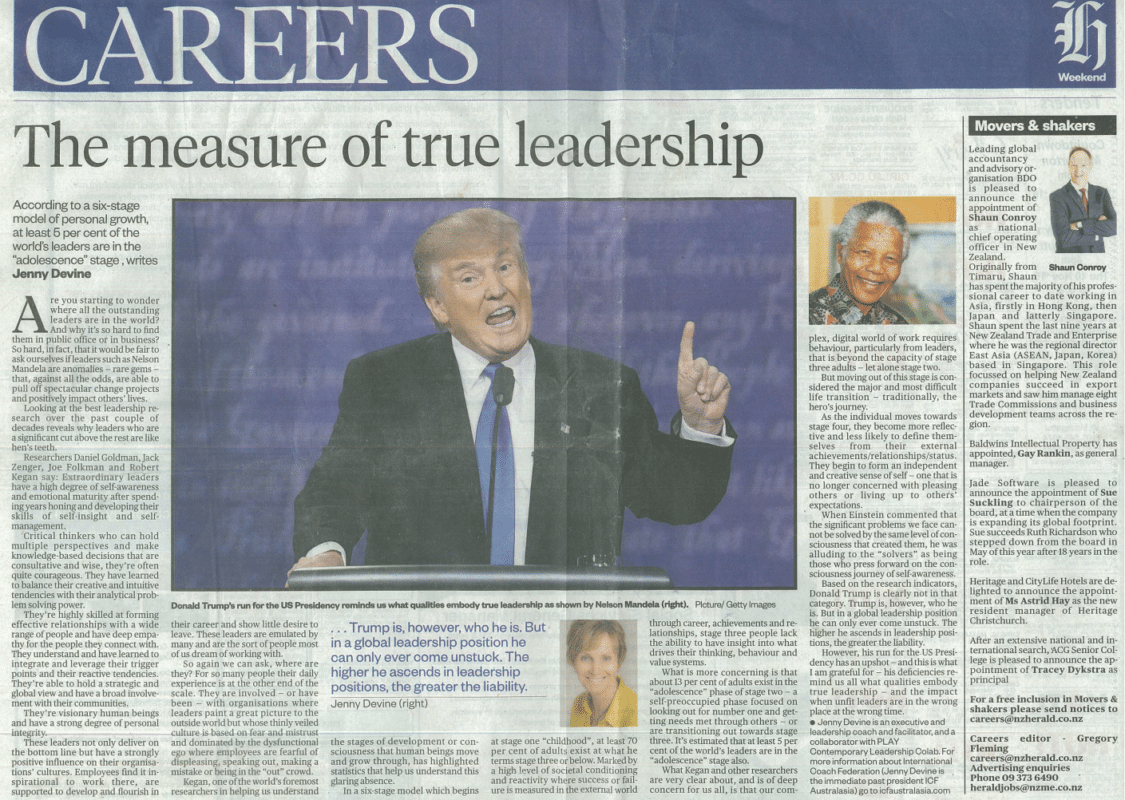

A few years ago I was surprised to appear alongside an article about Trump and leadership in the New Zealand Herald (that’s me on the far right). It prompted me to write a LinkedIn article about the experience and what I’ve since learned about leadership.

Connect with Shaun

Shaun hails from New Zealand and spent 23 years in Asia (Japan, Korea, China and ASEAN), including nine years leading the New Zealand Government’s Trade Commissions in Asia (excluding China).

In his spare time, you’ll find him doing yoga and drinking red wine (we’re assuming not at the same time).

If you’re keen to discuss business growth, reach out to Shaun.

+61 411 297 434