To P2P, or not to P2P? That is the question…

21.4.2020In the wake of the completing of the National Veterinary Care sale to VetPartners, we thought it would be interesting to present a summary of P2P transactions in Australia over the last 2 years, and see what the data tells us about P2P. P2P simply means the takeover of a listed (public) company so that it then becomes a private company, either independently (typically with the backing of a financial sponsor) or as part of a larger company (ie. a strategic buyer).

Over the last 2 years in Australia, 56 listed companies have been the subject of public to private (P2P) takeover attempts.

Of the 56 P2Ps in the last 2 years:

- 19 have been from international strategic investors, eg. DuluxGroup (Nippon Paint – Japan), GBST Holdings (FNZ Group – UK), Ruralco (Nutrien – Canada), Bellamys Australia (China Mengniu Dairy – China), ERM Power (Shell – Netherlands);

- 15 have been from International private equity investors, eg. MYOB (KKR), Scottish Pacific (Affinity Equity Partners), Greencross Vets (TPG);

- 11 have been from Australian strategic investors, eg. Fairfax Media (Nine Entertainment), Xenith IP (IPH), Chalmers (Qube Logistics); and

- 11 have been from Australian private equity investors, eg. Navitas (BGH consortium), and Zenitas Healthcare (Adamantem).

Given the number of transactions that have occurred, we decided to run the numbers to see what premiums are being paid, and the factors that influence this premium.

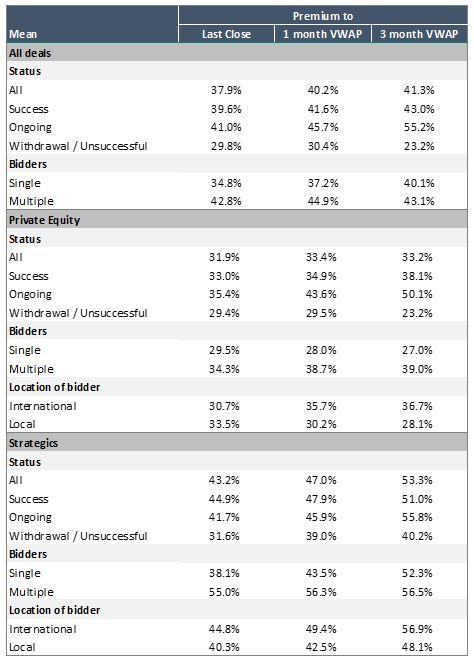

Focusing on the takeover price compared to the 3-month VWAP (Volume Weighted Average Price):

- The average premium across all transactions was 41%;

- The average for strategic investors was 53%, compared to 33% for PE deals;

- The average for successful deals was 43%, compared to 23% for unsuccessful deals;

- Where a strategic investor was involved, the average premium paid by international investors was 57%, compared to 48% for local buyers;

- The average where there were multiple bidders was 43%, compared to 40% where there was only one bidder.

The summarised data is presented in the following table.

These conclusions confirm what you would expect, and highlight that there can be a substantial difference in the price paid depending on the nature of the investor. Listed takeover targets can’t always control their fate, but they can control their preparation. We recommend always having a defence pack ready, and a plan for how to engage the bidders most likely to pay a strategic premium.