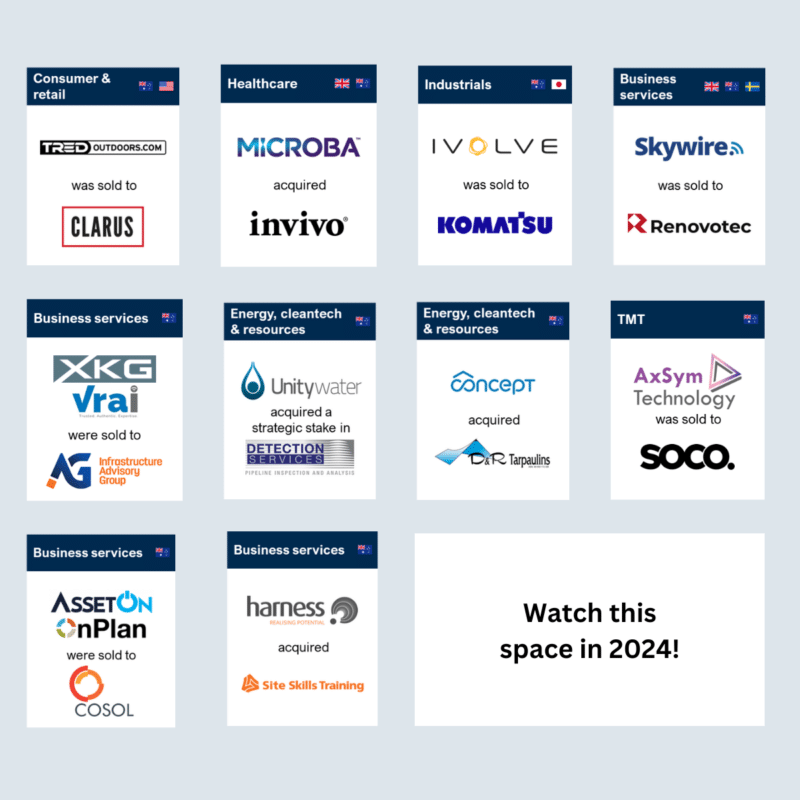

As we launch into 2024, we’re reflecting on a huge 2023 working closely with so many delightful clients and closing 10 deals across Consumer and Retail, Healthcare, Industrials, Business Services, Energy, Cleantech, Resources and Technology. As a result of this work, we’re thrilled to have been recognised at the top of the LSEG M&A league tables.

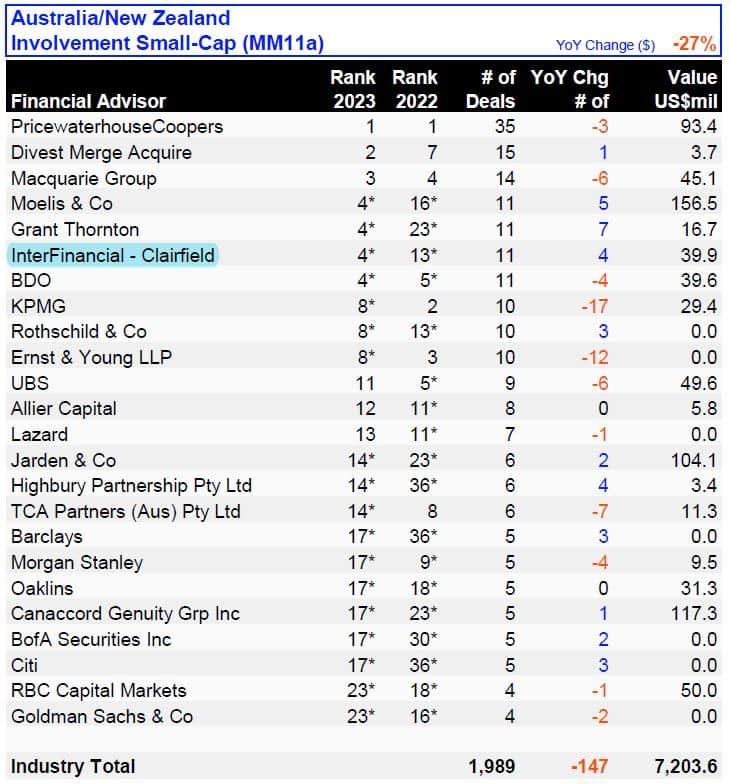

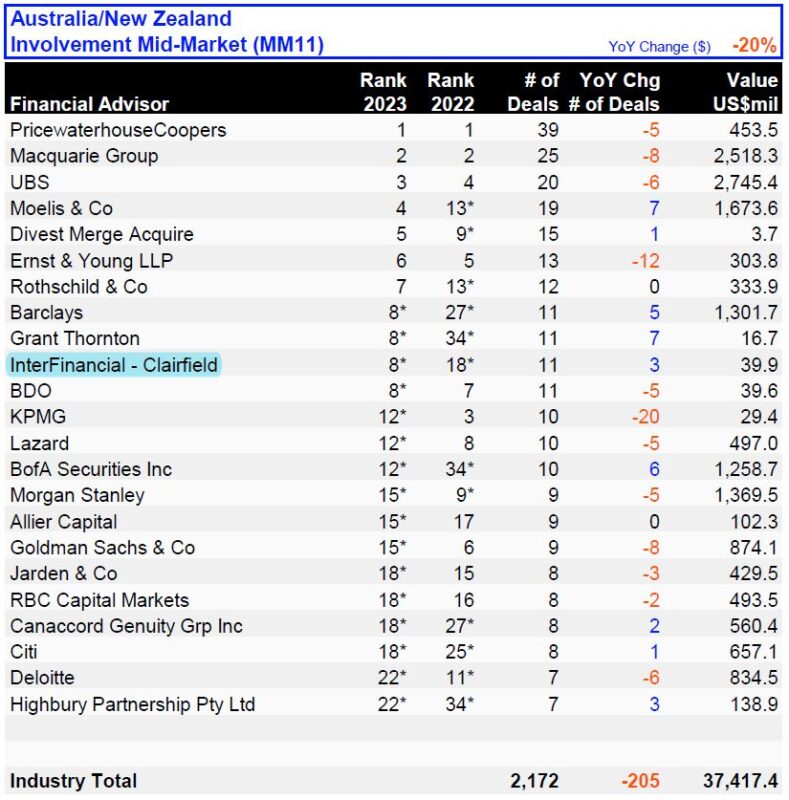

Each year, LSEG, a global leader in financial services intelligence, ranks each M&A firm based on the number and size of deals done. For 2023 InterFinancial – Clairfield (that’s us!) is fourth for small cap (<USD50milliion) deals, and eighth in the mid-market (<USD500million).

Unlike other firms who advise on M&A amongst other things like audit and accounting, we’re dedicated to mid-market M&A. Our senior team apply their real-world commercial experience, finding creative ways to balance shareholders’ expectations and achieve more for our clients. And, despite challenging macroeconomic conditions in 2023, we continued to do this.

Our continued ranking, ahead of other global firms, is a reflection of this laser focus on mid-market M&A and client outcomes. Our clients range from founder-led growth companies to family businesses to large, listed corporates, including VC and private equity backed businesses, and their financial investors. Many of these are years long relationships and post-deal, we continue to deliver value through our growth consultancy and advisory practice.

With a track record of over 195 deals announced worldwide in 2023, including many landmark deals, Clairfield ranked in the top 20 in the LSEG worldwide ranking of financial advisors. Clairfield credits this global success to a committed focus on the midmarket sector, which has been more stable amid broader industry fluctuations. In addition, increased activity in growth industry sectors, debt and ESG advisory as well as enhanced partnerships in key geographies coupled with strategic talent acquisition, has provided growth for the Clairfield Group.

Thank you to our clients for trusting us to be your partner on your journey. You can read some of their stories here: