Australia’s new merger control regime: What you need to know by 2026

30.9.2025Australia is heading into a new phase in how mergers and acquisitions are regulated. From 1 January 2026, a new mandatory merger control regime kicks in. That means if your deal crosses certain thresholds, you’ll need ACCC approval before completing.

There’s a transitional period from 1 July 2025, where businesses can start using the new system voluntarily, giving dealmakers a chance to test the waters early.

So, what’s actually changing and what does it mean for you?

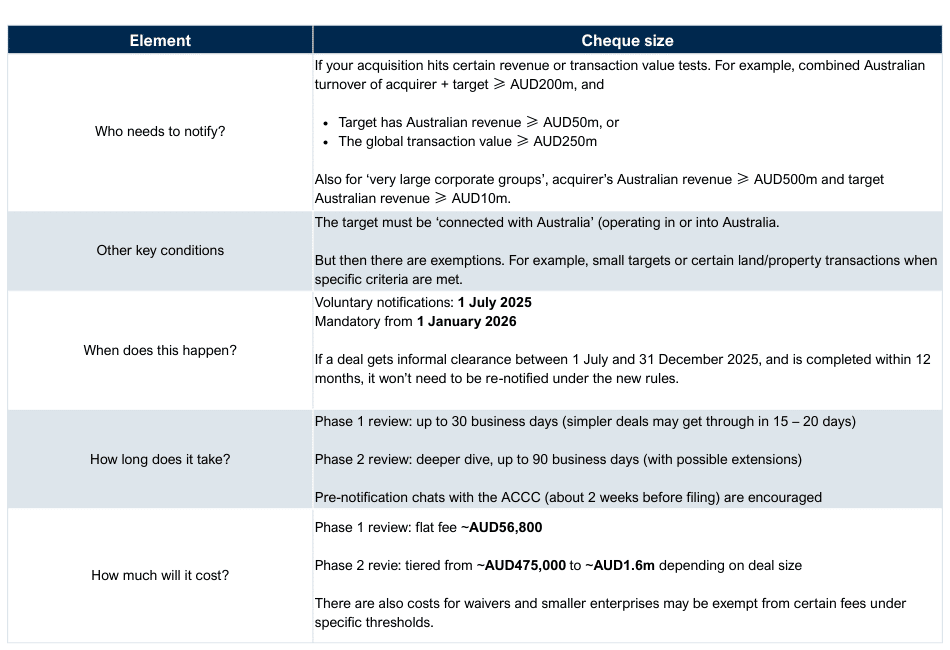

Regulation summary

Here are the key elements of the new regime, including thresholds, timing and costs:

What we’re already seeing in the market?

Even before the rules are mandatory, dealmakers are already adjusting:

- Contracts and discussions now factor in regulatory deadlines.

- Some deals are being pushed to wrap before 1 January 2026.

- Businesses are seeking clarity from the ACCC with questions (e.g. how cumulative acquisitions are counted, how ‘control’ is defined).

- A few parties are voluntarily notifying early to see how their deal stacks up.

In short: no one wants surprises.

What does it mean once the regime is live?

Here’s what dealmakers should expect from 2026 onwards:

- More rigorous planning: Expect to pull together detailed data (market shares, revenues, overlaps).

- Longer timelines: Some deals may need months for review.

- Higher costs: Filing fees + legal and economic advice add up quickly.

- Deal structure tweaks: Parties may consider alternative structures to avoid thresholds.

- Some slowdown: Deals close to thresholds or in concentrated industries may face delays.

- Clarity over time: Once the ACCC starts publishing decisions, we’ll all have a clearer picture. Until then, expect some uncertainty.

What should you do now?

- Audit your pipeline: Test current and upcoming deals against the new thresholds.

- Get in early: If possible, seek informal clearance or voluntary notification from mid-2025.

- Plan for time: Build review periods into deal timelines.

- Budget properly: Factor in regulatory and advisory fees.

- Stay informed: Watch for ACCC and Treasury guidance as the first wave of cases comes through.

Bottom line

The new ACCC merger control changes are real. Dealmakers are already adjusting timelines and strategies, and once January 2026 hits, regulatory planning won’t be optional. It’ll be front and centre of every transaction.

The good news? While the first year may bring some uncertainty, over time we’ll have more clarity on thresholds, costs and timelines. For now, the smartest move is to plan ahead, stay informed and factor in regulatory approval into your deal strategy.

If you want to further understand how these changes could affect your business or upcoming deals? Reach out to Executive Director, Brad Shaw, who’d be happy to chat through the details and what they might mean for you.

Source: ACCC Merger control regime