Is your business investment ready? How to raise enterprise value from an investor’s lens.

26.2.2025Working ON your business is just as important as working IN your business.

For many business owners, their business is their primary asset. But like with any asset, it requires regular maintenance to ensure it remains competitive, profitable, and most importantly, investment ready.

It’s important to consider the following key questions towards becoming investor ready:

- Do we have a revenue, costs, operations, people or products problem or opportunity?

- What are the key value drivers of my business?

- Are we achieving our business objectives with the present strategy?

- Is my business financially and operationally investment ‘fit’?

- What steps can we take to create value or reduce cost?

The five pillars of investment readiness

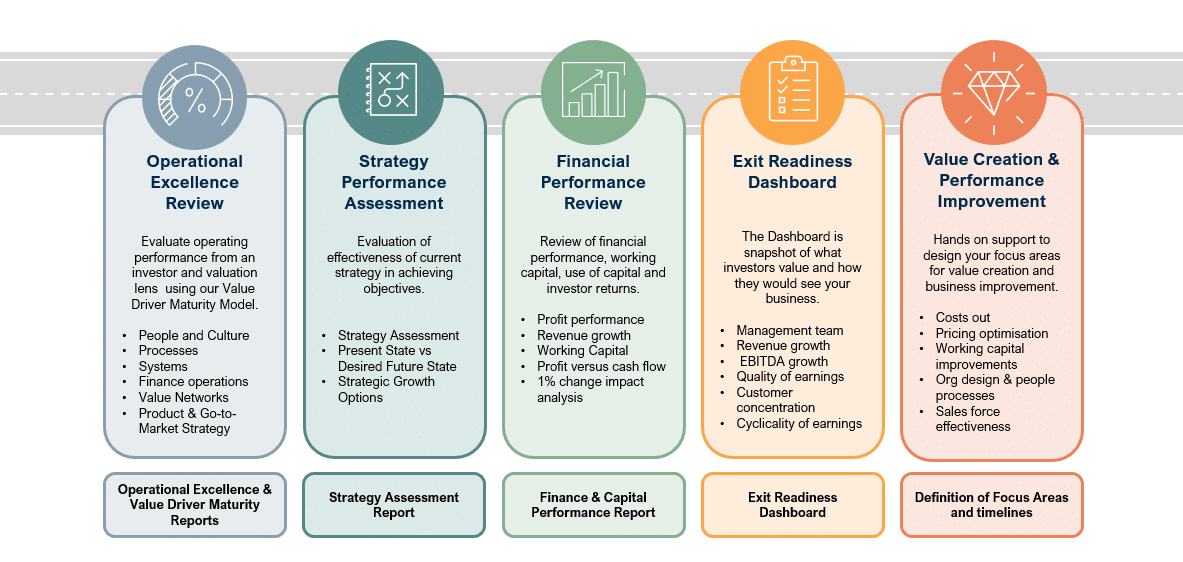

Our five pillars form the basis of our Investment Ready Pathway (IRP) process. The Investment Readiness Pathway is a comprehensive diagnostic, value creation and business improvement process.

The IRP utilises an investor’s lens to improve performance, prepare your business for growth, investment, and generate higher value for shareholders.

At the end of this, we help you define the focus areas for the next 12 months that will drive business improvement and value creation.

Developed with over 30 years of business improvement experience

The IRP isn’t just another business diagnostic tool. It’s built on over 30 years of experience in business improvement and investment markets, using 120 data points to assess a business’ true potential.

So, what sets it apart? It looks at businesses through an investor’s lens.

At the end of this process, the IRP delivers business improvement and value creation strategies that drive material improvements in valuation – not just by increasing revenue, but through sustainable earnings growth and valuation multiple expansion.

The IRP is a three-part diagnostic that looks at your business’ operational excellence, strategy effectiveness and financial performance over eight weeks. Then from here, we help you define key focus areas in business improvement and value creation while working alongside you over the next 12 to 18 months to deliver those actions.

Operational excellence, cost reduction, value creation

- What does operational excellence look like in the context of my business?

- Where can I achieve rapid cost reductions?

- What actions can I take to increase value

Business maintenance – working on the business ensures your company is investment ready regardless of whether you want to raise capital, sell the business or maximise profits.

Maximising your business’ valuation isn’t merely a stroke of luck or timing. Instead, it’s a deliberate process rooted in strategic planning, expert guidance and disciplined execution. Focusing on specific controllable risk elements to drive multiples and core operating performance can see improvements in revenue, volume, COGS and overheads, ultimately uplifting shareholder value.

With over 30 years of investment banking and financial services experience across key markets like Japan and Singapore, Director Shaun Conroy is deeply skilled in driving value creation for businesses long before M&A transaction take place. His ‘investor lens’ perspective has seen him working with clients to identify key value drivers and lead strategic initiatives that enhances both operational profitability and valuation multiples.

If you are considering a future investment, capital raise or exit for your business, reach out to Shaun for a confidential discussion on the Investment Ready Pathway that can maximise your business valuation.