Mapping the PE landscape: Types of Private Equity in Australia (Part 1)

25.6.2025Australia’s private equity (PE) sector is a dynamic and multifaceted market that supports companies through all stages of growth, from fledgling startups to mature enterprises. While it’s common to categorise private equity by business stage (early, growth, mature), several other key factors will help decide what may be the most practical private equity investor, these include cheque size, ownership structure (minority vs. majority), and investment horizon (long-term vs. fund-limited).

This article explores the main types of private equity in Australia through a more strategic lens, highlighting the unique characteristics and roles of each investment style.

Venture Capital: Fuel for startups

Venture capital is the lifeblood of Australia’s innovation economy. With typical cheque sizes ranging from $100,000 to $10 million, VC firms provide the early-stage capital that startups need to validate their business models, build teams, and go to market.

These investments are almost always minority stakes, often between 10% to 30%, and are made with a long-term view. Venture funds in Australia typically operate on a closed-end structure with investment horizons of 8 to 10 years, offering ample runway for portfolio companies to grow and exit via acquisition or IPO.

Capital will almost exclusively be put to work into the business (i.e. no one is selling shares and getting out).

Venture capital is highly active in tech, life sciences, fintech, and climate innovation, areas where growth can be exponential and speed is everything. Leading players include Blackbird Ventures, AirTree, and Square Peg Capital.

Growth Equity: Scaling established businesses

Growth equity, sometimes referred to as expansion capital, comes into play when a business is already performing well but needs capital to scale further. Typical cheque sizes here range from $10 million to $100 million, and the ownership structure can vary. Some deals involve significant minority stakes (20–49%), while most are structured as effective control positions in more a partnership model (50–80%).

This form of private equity suits companies that are past the startup stage but not yet ready for a public offering or strategic sale. The business will typically be profitable with $5m+ in EBITDA. It’s particularly useful for market expansion, new product development, or funding acquisitions.

Capital use is often a combination of existing shares (i.e. partial sell down for key people) and capital into the business to fund growth.

While many growth equity investors operate within closed-end fund structures, others including family offices, offer more patient capital, allowing for longer, more flexible holding periods.

The spectrum of players in this part of the market are broad and include the likes of ABGF, Whiteoak, Advent Partners, and Armitage Associates.

Buyouts: Taking control to drive change

At the more mature end of the spectrum lies buyout capital. These are large-scale transactions, often involving cheque sizes of $50 million to over $2 billion, and almost always involve majority ownership of the company.

Buyouts include:

- Management Buyouts (MBOs), where internal teams acquire the business with PE backing;

- Leveraged Buyouts (LBOs), which use a mix of debt and equity to amplify returns;

- Public-to-Private (P2P) deals, in which listed companies are taken private to facilitate transformation.

These investments are typically held for 3 to 7 years, with the aim of creating value through operational improvement, strategic repositioning, or bolt-on acquisitions. Firms like Pacific Equity Partners, BGH Capital, Quadrant Private Equity, and Adamantem Capital are some of the large local players in this space, while International firms with local offices including KKR, EQT, and TPG also vie for deals.

Distressed and special situations: Turnaround Capital

Distressed or special situations investing focuses on businesses in crisis or undergoing significant disruption. These investors step in with $5 million to $200 million or more in capital, usually seeking majority control to lead a turnaround or restructuring.

These investments are inherently higher risk but can offer substantial upside when successful. The investment horizon is often shorter (2 to 5 years), as the goal is to stabilise, restructure, and exit, sometimes through a sale, recapitalisation, or re-listing.

This segment is especially relevant during economic downturns, sector-specific upheavals, or corporate crises, where speed and decisiveness are critical.

Key players in Australia include Allegro Funds and Anchorage Capital Partners and more recently we have seen Bain Capital acquire and just recently relist Virgin Australia after it went into administration.

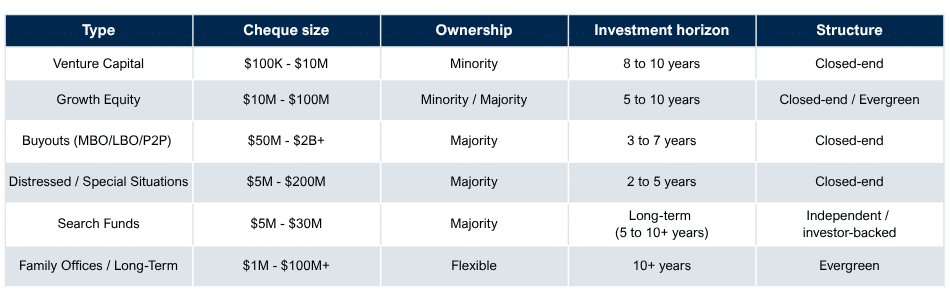

Private Equity types in Australia: Summary comparison

Choosing the right PE

As we’ve seen, private equity in Australia spans a diverse range of approaches – and this is only the first half of the story! From supporting startups to scaling high-performing business and carrying our transformative buyouts, the goal is to find alignment between business owner and PE partner through matching the personalities, values, growth ambitions, capital requirements, time frame, exit ambitions, and ownership structure.

If you’re a founder or executive exploring PE options, we invite you to reach out to Michael Kakanis to explore what type of investment partner may be right for your business.

Also, stay tuned for Part 2, where we’ll dive deeper into family offices, the rise of search funds, blended and specialist PE strategies.