Mapping the PE landscape: Types of Private Equity in Australia (Part 2)

30.7.2025In our previous article, we explored the different types of private equity in Australia and the role each plays in helping businesses grow, transform, or turn around. These include Venture Capital, Growth Equity, Buyouts and Turnarounds.

This month, we look at some of the more emerging parts of the PE landscape.

Family offices and long-term capital: Patient and strategic

In contrast to traditional private equity funds, family offices and long-duration investors provide flexible, longer term capital. Their cheque sizes vary widely, typically between $1 million and $100 million+, and ownership stakes can be minority or majority. The defining feature is the long-term horizon, often 10 years or more, with no pressure to exit based on fund life.

Family office investors tend to prioritise alignment of values, sustainable growth, and governance participation over aggressive growth and exit. They are particularly attractive to founders looking for strategic partners who can grow with the business for the long haul.

Examples include Alvia Asset Partners, Stonehouse Corporation, Seidler Equity Partners, PieLab Capital, and Arbor Permanent Owners.

Search funds: A pathway to entrepreneurial acquisition

An increasingly recognised segment of Australia’s private equity landscape is the search fund. It’s a model that combines entrepreneurship with private capital. A search fund is typically launched by an individual or small team of entrepreneurs who raise capital from investors to search for, acquire, and operate a single private business, usually a small to mid-sized, profitable company with growth potential.

Cheque sizes for search fund acquisitions in Australia typically range from $5 million to $30 million, targeting businesses with stable cash flows, strong market positions, and a desire for owner transition (often family-run businesses without clear succession). Ownership is almost always majority, with the searcher stepping into an active CEO or management role post-acquisition.

While more common in the United States and Europe, search funds are gaining traction in Australia, supported by a growing ecosystem of local and international investors interested in backing entrepreneurial operators.

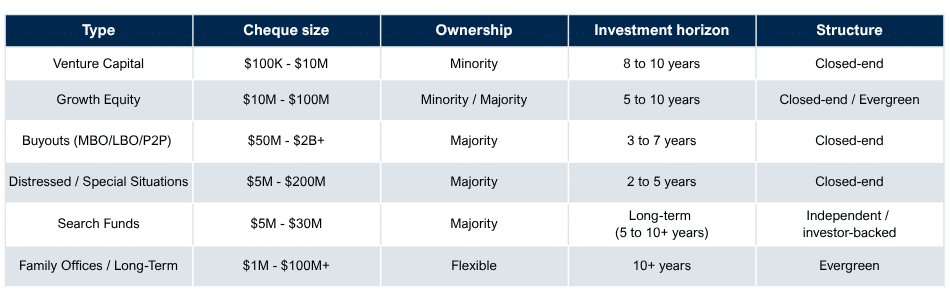

Private Equity types in Australia: Summary comparison

Local vs. international PE in Australia

Australia’s private equity landscape is shaped by both domestic fund managers and international investors, each bringing unique advantages. Local PE firms possess deep familiarity with the regulatory environment, industry dynamics, and cultural nuances, allowing them to identify opportunities others might miss and support businesses with hands-on operational guidance. Meanwhile, global funds, particularly from North America, Europe, and Asia, are increasingly active in Australia, drawn by the country’s stable economy, sophisticated financial markets, and attractive sectors such as infrastructure, healthcare, and fintech. These international players often bring larger cheque sizes, cross-border expansion capabilities, and global networks.

International PEs with a local office include the likes of EQT, KKR, and The Riverside Company.

Blended strategies: Funds spanning multiple investment types

While private equity is often segmented into distinct categories like venture capital, growth equity, and buyouts, many investment firms in Australia operate across multiple strategies. Several local and international funds have both VC and growth equity arms, allowing them to support companies from early-stage through to scale-up.

Similarly, growth and buyout strategies are frequently housed within the same fund or platform, enabling investors to adapt their approach based on the company’s maturity and capital needs.

These hybrid structures provide flexibility as investors can tailor cheque size, ownership levels, and governance roles based on each unique opportunity. For founders and management teams, this can mean building long-term relationships with capital partners that evolve over time, rather than switching between investors at each stage of growth.

Locally, Five V Capital covers VC through the buyout, while the likes of Quadrant have both buyout and growth capital mandates.

Sector specialists: Subject matter experts

Private equity firms with sector expertise look to bring value to their portfolio companies by combining financial backing with deep industry knowledge. These firms typically focus on specific sectors such as healthcare, technology, industrials, or consumer goods, allowing them to develop a nuanced understanding of market dynamics, regulatory frameworks, competitive landscapes, and key value drivers within those industries.

This expertise enables them to identify attractive investment opportunities, execute more accurate due diligence, and add operational value post-acquisition.

Additionally, their established networks of industry executives, advisors, and potential strategic partners can accelerate growth and improve governance in their portfolio companies.

While most PE funds will have a number of sectors where they do more deals and have strong subject matter expertise, we are seeing the emergence of more sector specialist PE firms. Examples include Potentia Capital (Tech), Genesis Capital (Healthcare), Viburnum Funds and Resource Capital Funds (Resources).

Final thoughts

The private equity landscape in Australia is broad, sophisticated, and evolving. Whether you’re an entrepreneur seeking seed capital or a founder exploring exit options or growth capital, understanding the nuances, not just by stage, but by cheque size, ownership, and investment horizon, is crucial.

Each type of private equity serves a distinct purpose, and selecting the right partner can mean the difference between stagnation and breakout success.

If you’re a founder or executive exploring PE options, reach out to Director Michael Kakanis to discuss if a PE partnership may be right for your business.