Rocking the mining sector – time for buyers to be a little boulder?

21.11.2018Over the last 12 months, an increasing number of mining services companies have approached us wondering where we are in the cycle, and when the right time is to start looking for a partner / exit. After riding the highs and lows of the last boom, owners are either exhausted and keen to get off the rollercoaster, or have weathered the storm and want to position early for the next uptick.

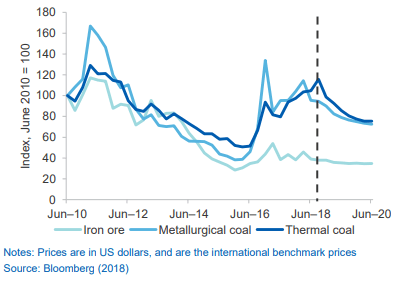

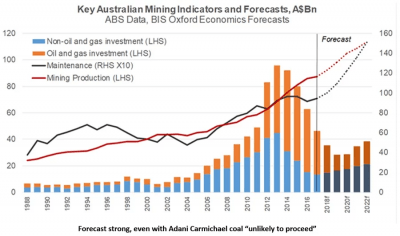

Looking at the stats, the “recovery” is far from conclusive. Commodity prices staged something of a comeback in 2018, but the outlook for the next 2 years is flat at best. Investment in mining operations seems to have stabilized, but again the outlook is “cautiously optimistic”. However, according to the below ABS / BIS data, the real opportunity is in operating and maintaining the investment already made at the height of the boom.

Investors seem to be cottoning on to this. Over the last 18 months there have been a number of transactions in the mining services sector, as detailed in the table below. Most of these provide people, equipment, or maintenance services to mine owners as they ramp up production.

So, what advice can we give owners who are considering a transaction in the next few years?

- Read the signs. The charts are far from conclusive, but anecdotal evidence is positive. Lead times are pushing out for equipment purchases, people are getting harder to find, and transactions are starting to happen. If prior experience is anything to go by, when the momentum shifts it will happen quickly;

- Prepare early. If some one knocks on your door, are you ready? Do you know what your criteria are for engaging with a potential buyer? Are you preparing information in a way that would make your key selling points clear to a buyer? Would your information stack up in due diligence? First impressions count, and you may only get one chance;

- Tailor your message. It’s important to not just tell your story, but also consider why you might be attractive to particular buyers. How can you help a buyer take advantage of increased sector activity? What do you offer that they can’t build organically – access to particular customers or projects, skillsets, or a team of people that’s hard to replicate? What does your balance sheet look like – if you’ve got low debt, can this help the buyer improve their own leverage ratios?

- Succession planning. You need to have an answer for why you are trying to exit, and what the business looks like without you. Who has the relationships with customers and suppliers? Is there a management team? What are the growth opportunities for the next owner?

Of course, if you need some help framing this story, you know where to come! InterFinancial has a long history working with mining services businesses, and we are in regular contact with investors in the sector. If you would like to discuss your growth or succession options, please contact Brad Shaw or Mark Steinhardt on 07 3218 9100.

Author: Mark Steinhardt & Brad Shaw