Seeking an immediate exit, investment, or business growth? Whatever your objectives, understanding your business’ value and how to increase it is a key part of achieving them.

The most common way to value a business is first to take the industry multiple and multiply it by your company’s earnings. The multiple is always a range which you have very limited control over. It’s determined by industry cycles, global markets and various macro-economic factors.

Each month, InterFinancial publishes the multiples for each sector*- take a look at the latest here.

So, how is it that two businesses in the same industry, with the same earnings, can attract entirely different sale values?

Ultimately, what your business is worth comes down to what someone is willing to pay for it. But, from experience, we know that there are several qualitative factors that go right to the heart of business value. Identifying and focusing on these value drivers is the key to shifting the needle on your business value.

Understanding value drivers – where to begin

Identifying and paying attention to an organisation’s value drivers will not only improve the value of that business, it will also enable it to:

- Lower its business risks;

- Improve its ability to access capital (both debt and equity) and on more favourable terms;

- Be viewed more favourably by its potential clients;

- Increase its capability towards best practice; and

- Enhance its position in the marketplace because it is considered best practice.

Once the value drivers of a company have been identified, it’s possible to assess the company’s performance for each against benchmark companies. This will help you to identify which ones are driving value and which ones are detracting from the value. These are the positive and negative drivers.

While it’s possible to focus solely on the positive factors, the greatest uplift in value may come from improving the negative factors and concentrating on those aspects that provide the greatest returns. Mapping out a strategy that focuses on these factors is the next step to improving the value of the business.

A proven methodology to identify and improve business value

Over three and a half decades in M&A, the team at InterFinancial has developed a deep understanding of business value and value realisation. Through working with hundreds of organisations to improve their business value, we have developed our Value Factor Analysis methodology. This methodology identifies the key value drivers of an individual organisation and then provides steps to improve on these drivers.

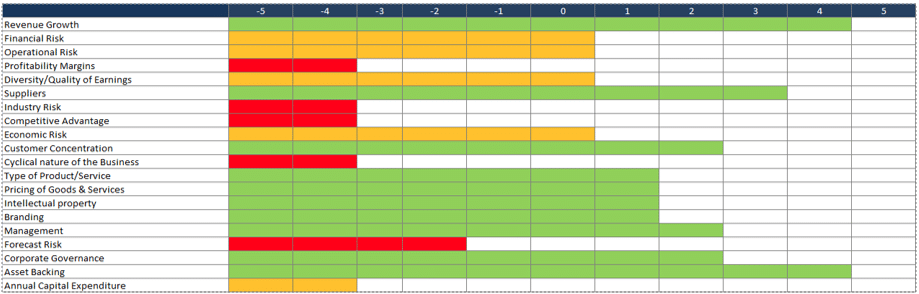

Here’s a generic example Value Factors Analysis report. It shows where a company performs above average (green), average (yellow) and below average (red) against similar companies in its industry. If improved on, the red areas often have the most upside in terms of value. In this example they are: profitability margins, industry risk, competitive advantage, cyclical nature of the business and forecast risk.

Once we’ve completed this values analysis, we’ll work together to put in place an action plan to influence the value drivers. If necessary, we’ll also establish an advisory board to maintain a focus on delivery, measurement and constant improvement.

Your shareholders’ objectives will determine how this value is eventually realised. It may be through an eventual sale of the business, or simply through a better organised, controlled and integrated operating model.

A case study in improving business value

In 2016, an Environmental Services and Renewable Energy business came to us seeking strategic advisory support and succession planning.

We began by analysing their value drivers to identify the areas of greatest risk and opportunity. Through this work, we identified several factors that would increase their business value. These included diversification of their offering, performing strategic acquisitions and removing their ‘key-person risk’.

Since then, we’ve worked together on strategy, put interim executives in place and helped them build their leadership team. We’ve also scanned the market for acquisition opportunities and executed an acquisition on their behalf.

Six years on, these programs of work have played a role in significantly increasing their business value. And we continue to work alongside the team to assess their value drivers and deliver on programs to increase and realise that value.

Find out more

Find out more about InterFinancial’s Services here. And, if you’re thinking about exit or growth and would like to understand the value drivers in your business and how to increase your value, get in touch.

*InterFinancial’s dashboards contain the industry multiple for large, listed companies. Small, privately held companies should expect a lower multiple. Speak to us for more advice.