EOFY2024: a year in review

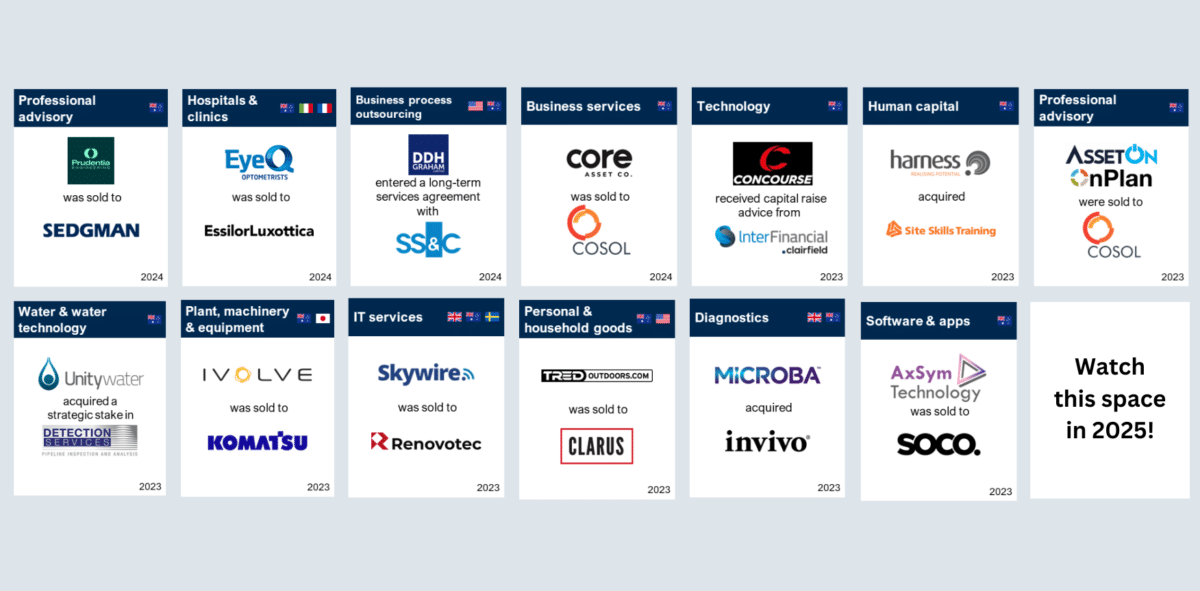

12.8.2024Another year has flown by, and what a year it was! From strategic partnerships to international expansions, 2024 saw InterFinancial at the heart of some truly transformative partnerships.

13 transactions. Numerous opportunities created. As we look back on FY24, we’re excited to share the stories behind the numbers – stories of businesses taking bold steps, crossing borders, and reaching new milestones.

Grab a coffee and settle in as we commemorate an amazing year that redefined what’s possible in the world of mergers and acquisition. From healthcare and consumer goods to industrial and technology sectors, our clients have shown that with the right guidance, there’s no limit to what can be achieved. So, if you’re ready, let’s jump straight in:

Prudentia forge close ties with Sedgman sale

Prudentia taps wider markets with strategic partner Sedgman.

InterFinancial acted as the sell-side advisor to Prudentia.

Read more

Private equity buyers target optometry group EyeQ

EyeQ navigates tricky market conditions with sale to global optometry giant, Essilor Luxottica.

InterFinancial acted as the sell-side advisor to EyeQ.

Read more

Local fleet management iVolve marks cross-border milestone

iVolve’s cements strategic partnership with Komatsu sale.

InterFinancial acted as the sell-side advisor to iVolve.

Read more

Venlo Group divests mature product to listed US company

Venlo Group raises capital to fund US expansion by partnering with North American Clarus Corp.

InterFinancial acted as the sell-side advisor to Venlo Group.

Read more

Core Asset Co becomes new competency for COSOL

Core Asset Co provides new technological capability with sale to key industrial player, COSOL.

InterFinancial acted as the sell-side advisor to Core Asset Co.

Read more

Preferred mobility provider Skywire secures cross-border investment

UK-based Renovotec marks first APAC investment with Skywire acquisition.

InterFinancial acted as the sell-side advisor to Skywire.

Read more

Multiple parties drive up sale price for AxSym

Canberra-based AxSym becomes new territory for SOCO.

InterFinancial acted as the sell-side advisor to AxSym.

Read more

ASX-listed Microba embarks international growth phase

Microba taps new market with UK-based Invivo Clinical acquisition.

InterFinancial acted as the buy-side advisor to Microba.

Read more

Unitywater lands strategic investment against the odds

Despite coming late to the table, Unitywater lands minority stake in pipeline technology company, Detection Services.

InterFinancial acted as the buy-side advisor to Unitywater.

Read more

AssetOn’s long-term growth plan bears fruit

AssetOn shareholders’ plan for successful exit with COSOL sale.

InterFinancial acted as the sell-side advisor to AssetOn.

Read more

DDH Graham streamlines business operations with SS&C partnership

DDH locks in long-term services agreement with existing SS&C partnership.

InterFinancial acted as the sell-side advisor to DDH Graham.

Read more

Harness Energy adds new service competency with industry training provider acquisition

Harness Energy acquires Verbrec’s Site Skills Training portfolio.

InterFinancial provided buy-side advisory services to Harness Energy.

Read more

Capital raise positions Concourse for IP commercialisation

Concourse raises capital to assist in IP sale to global mobility equipment supplier.

InterFinancial acted as capital raise advisor to Concourse.

Looking to grow, seeking investment or an immediate exit?

Our senior team will roll up their sleeves, applying their real-world experience to help you build and then realise long-term value. Working with shareholders of mid-market companies – valued between $20-350m – our services span growth advisory, buying and selling businesses, and capital raising. Around since 1987, and with more than 300 successful deals under our belt, we’re consistently ranked in the top 10 in mid-market M&A in Australia. InterFinancial is part of Clairfield International, a group of mid-market M&A specialists in 32 countries, so we can open doors for you at home and around the world. Contact our team today!